This is great information on choosing between conventional or FHA financing, provided by Julie Hirsch with Sterling Bank. If you're shopping for a loan, it's a good idea to investigate all your options.

"Over the last five years, we have seen some shifting whether it makes more sense to go Conventional or FHA. From the time period of 2008 to 2010, it made more sense to go FHA rather than Conventional unless the client had a 10% down payment. As FHA continues to have loan losses, it has been annually increasing the cost of financed and monthly mortgage insurance. In April of this year, FHA will increase the rates on mortgage insurance again. It’s probable that the mortgage insurance will no longer be removable even between year five and ten.

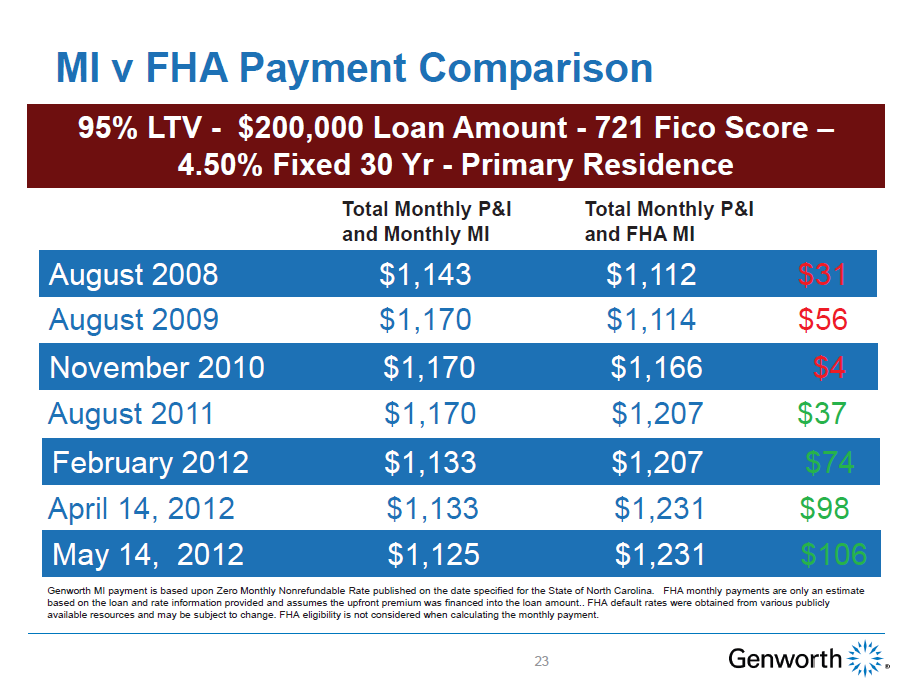

If you take a look at the image then you will see that it’s actually less expensive to go Conventional even with as low as a 5% down payment. Disregard the 4.50% interest rate. Genworth used this rate over the entire five year period to keep it’s charting consistent. The chart doesn’t account for the variance in rates. FHA rates are approximately .25% lower which will negate some of the increased cost. However, as of May 2012, the FHA mortgage insurance payment was $106 higher than Conventional.

When do we still use FHA? FHA is still a better option when we have low credit scores, high debt to income ratios, gift funds, co borrowers, and possibly for a 3.50% down payment.

It’s important going forward that lenders look at both Conventional and FHA options for the client. Conventional with private mortgage insurance may make more sense for the majority of clients."

Written by:

Julie Hirsch

Loan Officer, NMLS #487461

Sterling Bank | Lake Washington Branch | 2536

10230 NE Points Dr., Suite 530, Kirkland, WA 98033

Direct: (425) 893-5717 | Fax: 425-650-7129

julie.hirsch@bankwithsterling.com

Graph provided by Genworth.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link